When it comes to energy, the one thing that most of us would like to know is, “What will happen to our gas and electricity prices over the next 12 months?”

It is, of course, possible to find a well thought out response to this question - one which takes into account latest trends and energy market projections. But you only have to look back in history to see that actual prices are largely driven by events that no one can predict.

The wholesale cost of gas and electricity makes up about half your energy bill with the remainder being the cost of distribution, transmission charges, environmental costs, meter provision and your energy supplier’s costs and profit.

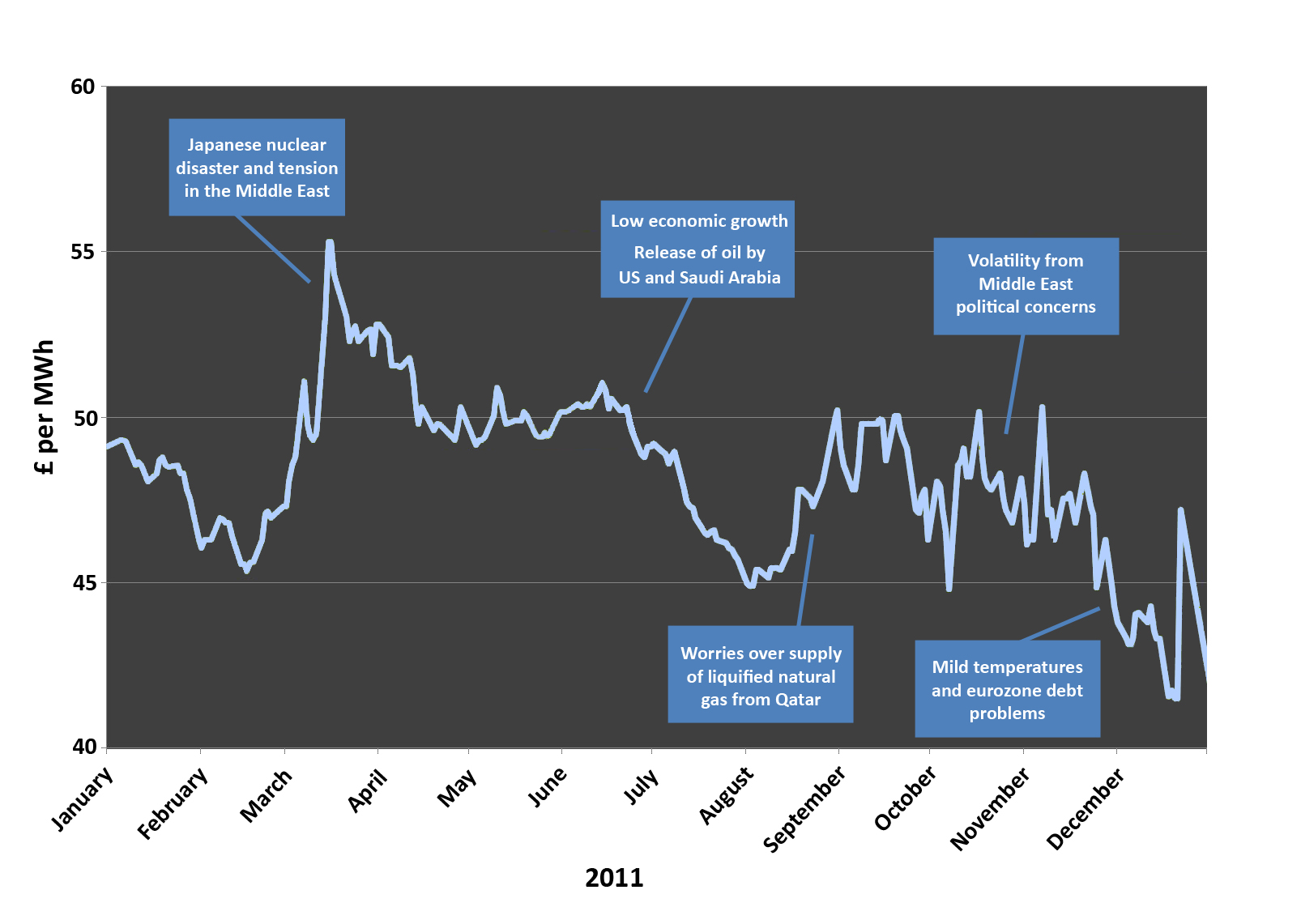

So the greatest single impact on energy bills comes from changes to the wholesale price which is affected by political and economic situations and natural disasters around the world. And, as Britain becomes more reliant on imported gas, our gas prices are increasingly influenced by these world events, especially those that affect the price of oil.

For example, in 2011, who could have foreseen the earthquake and tsunami in Japan, which led to nuclear closures and the Japanese importing huge supplies of Liquified Natural Gas? Along with the unrest in Libya and the Middle East and the ongoing eurozone crisis generally shook confidence and meant risks to world supplies and rises in the Brent oil price.

Click on the graph image to see a larger version.

So is there anything you can you do to safeguard yourself from this prevailing global instability?

You can renew your energy contract up to 12 months in advance and set your energy price at the current level giving protection from potential market volatility in the short term.

If you are a big enough user, you can also look for a ‘flexi deal’ and buy a proportion of your requirements on the long term market for a fixed price, and float the rest. You’ll pay a small premium for the long term fixed component, but you will secure a degree of price stability in return. The ‘floated’ component is more of a risk but will carry no premium.