How it works

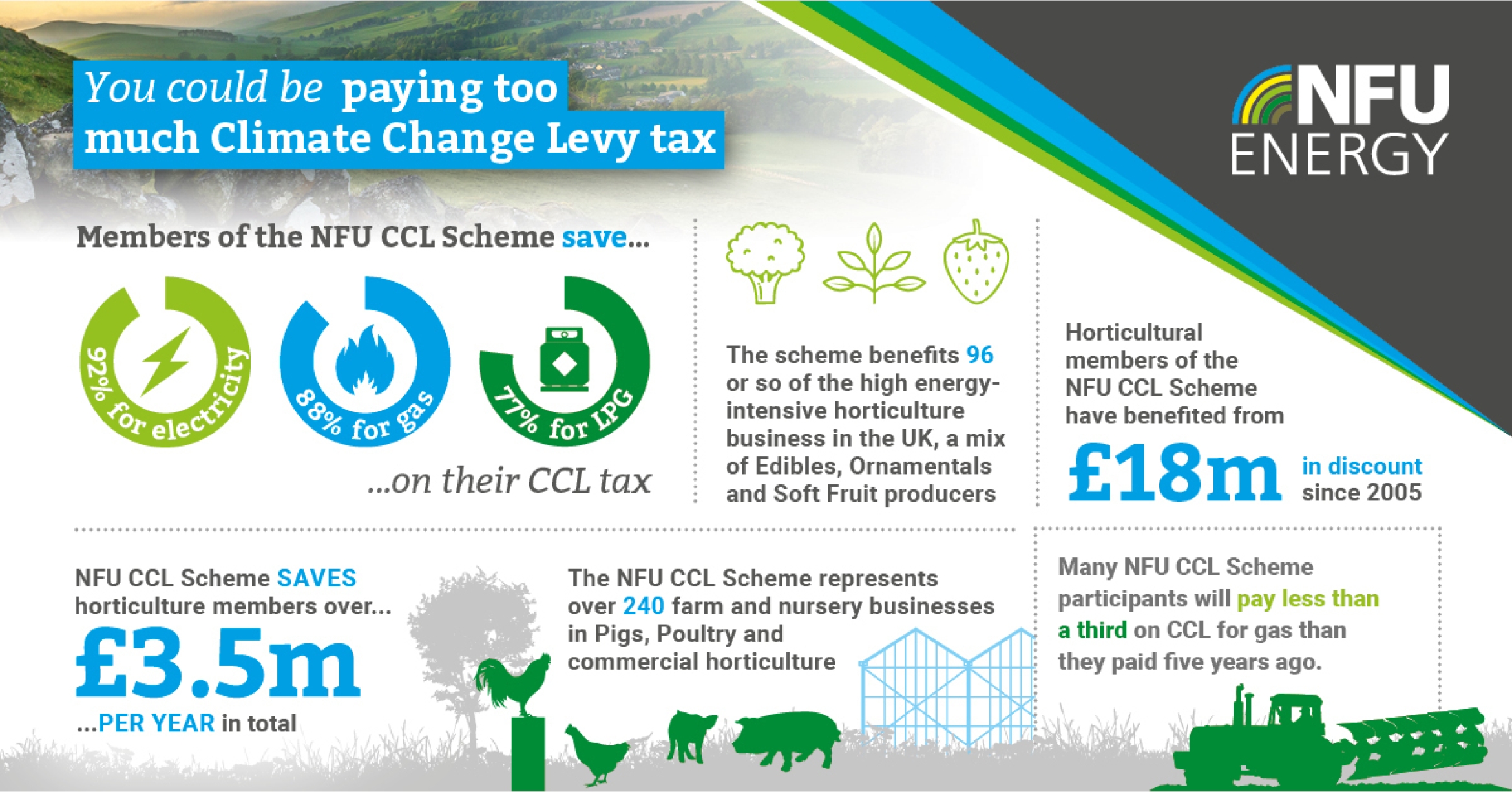

The extension of the CCA scheme until March 2033 provides energy-intensive businesses with the opportunity to continue benefiting from Climate Change Levy (CCL) tax discounts. Through the NFU CCL Scheme, businesses can receive expert guidance to meet energy reduction targets and maximise their savings, helping them stay competitive while reducing their carbon footprint.

If you currently hold a Climate Change Agreement our CCL experts can assist with:

- Ensuring ongoing compliance: for instance, are you keeping sufficient records? Are your process map and 70:30 assessment up to date? Have you made any changes to which the Environment Agency should have been notified?

- Support before and after audits: we can help to ensure you're ready for an audit and/or assist you in responding and carrying out necessary actions after an audit

- Ensuring that you've claimed and have been receiving all the discount you've been entitled to and helping with any back claims

How you benefit

- Reduces the burden of administering the scheme yourself – you keep all the necessary records and we provide the process, system, regular communications, and ongoing support to make all the reporting and admin as easy as possible for you.

- Assures your compliance with the scheme for as long as it lasts – you benefit from our experience of running the scheme since it started in 2001 and we keep on top of and let you know about all scheme changes and developments.

- Access to and simple explanations from friendly, down-to-earth advisers - to help you understand exactly what you need to do and answer any questions at any time.

What to do next

Call our CCL team on 024 7669 3043 to discuss how we can help you or members of the NFU CCL Scheme can visit its dedicated CCL website for supporting information.