Natural gas Combined Heat and Power (CHP) has long been an attractive option for sites with a combination heat, electricity, and CO2 demand. The systems combine the use of a heat engine or power station to generate electricity and useful heat at the same time. Cogeneration is a more efficient use of fuel or heat, because otherwise-wasted heat from electricity generation is put to some productive use. However, with the drastic increases in both gas and electricity costs, as well as decarbonisation pressures, its viability may not remain so attractive for much longer.

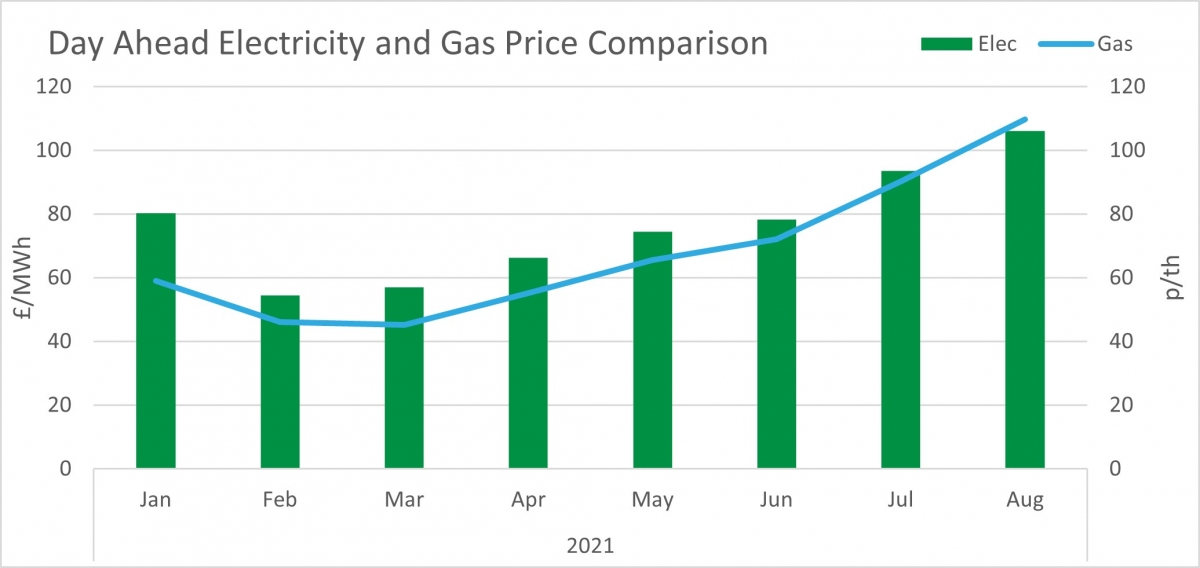

Throughout 2021 both day-ahead gas and electricity prices have been increasing, and recently, gas has risen at a much greater rate – see chart below. This has caused the spark spread (the difference between the wholesale market price of electricity and its cost of production using natural gas) for CHPs to worsen.

Spark spread is a measure of how profitable electricity generation from natural gas is, i.e., the difference between the value of electricity and the cost of the gas used to generate it.

As the decreasing spark spread reduces the viability of a CHP greater importance is placed on using the heat, and possibly CO2 that it produces.

As we move towards a ‘Net Zero’ future carbon ‘taxation’ in the form of UKETS (UK Emissions Trading Scheme), embedded gas cost, and other reduction systems will likely increase. Conversely, the continued decarbonisation of the electricity grid will likely reduce the impact of carbon taxation on electricity prices to a point where cost and emissions both reduce together simultaneously.

While it may not make financial sense to run CHP for electricity export throughout the day, by keeping an eye on the energy markets, lucrative electricity prices can be targeted to maximise payments. Additionally, having on-site electricity generation opens the doors to schemes such as the Capacity Market, which can provide extra value to the system. As well, pure CO2 remains expensive, in the region of £155/tonne, so there is value to be had in using natural gas CHP for CO2 enrichment.

We see natural gas CHP as a short-term solution to cover the heat, electricity, and CO2 demands on site. If a CHP system can be operated in a way that pays itself back within around a 5-year timeframe, it is probably a safe investment, but longer timeframes start to become riskier. We have extensive experience in modelling and managing natural gas CHPs across several sectors, and can calculate with great detail exactly how long pay back will take as well as looking at efficiency and scalability to suit your circumstances. Please get in touch and we will explain the process further.