Calling all members of the NFU CCL Scheme...

On 01 April 2019, the Government is increasing Climate Change Levy (CCL) Rates and the level of discount you receive as part of the Climate Change Agreement (CCA) you hold under the NFU CCL Scheme. You must complete new PP10 and PP11 forms in order to continue receiving this discount.

The new CCL rates are:

|

Dates |

Electricity per kWh |

Gas per kWh |

LPG per kg |

Solid fossil fuels per kg |

|

01 Apr 2018 – 31 Mar 2019 (current rates) |

0.583p |

0.203p |

1.304p |

1.591p |

|

01 Apr 2019 – 31 Mar 2020 |

0.847p |

0.339p |

2.175p |

2.653p |

The new levels of discount are:

|

Dates |

Electricity |

LPG |

All other CCL fuels |

|

01 Apr 2018 – 31 Mar 2019 (current rates) |

90% |

65% |

65% |

|

01 Apr 2019 – 31 Mar 2020 |

93% |

78% |

78% |

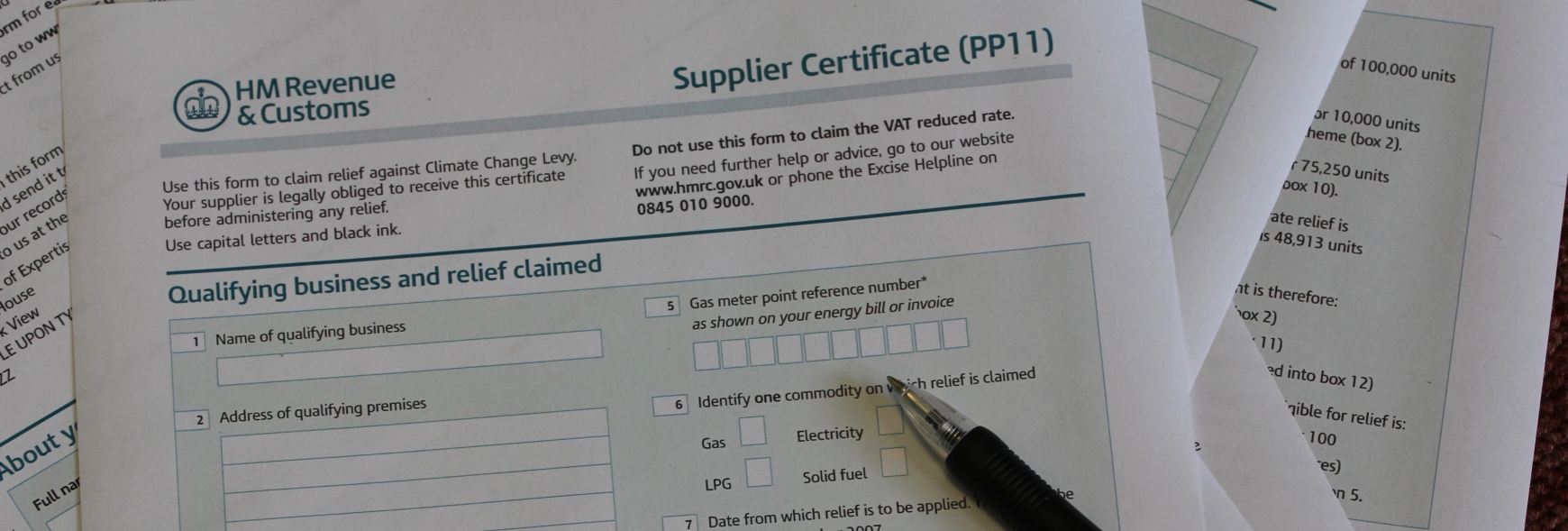

Whenever the levels of discount change, where fuel/energy used at a site are covered by a CCA, you must submit new PP10 forms to HMRC and new PP11 forms to each supplier in order to continue to receive CCL relief.

To obtain new PP10 and PP11 forms, visit www.gov.uk and search for ‘PP10’ and ‘PP11’. A separate form should be completed for each commodity, printed, signed and issued to the relevant organisation.

For further guidance, log into our website at http://ccl.nfuenergy.co.uk/ using the same username and password as for completing your CCL Data Return and click on “Your Responsibilities”. Whilst there, look at the “Your Discount” section to find out how to check that you are receiving CCL discount, and how to reclaim overpaid CCL when you haven’t received the discount.

We have found that it’s not uncommon for scheme members to forget to claim their CCL relief, so don’t forget to send the forms off whenever you change supplier, whenever the levels of discount change, or at least once every 5 years. Then, check your bills to ensure you’re receiving the discount. Levels of relief will change again in a year’s time.

Do not hesitate to contact the CCL Team on 024 693043 or by email [email protected] if you have any questions.